I think learning about supply and demand curves has given me a reason to fuel my online shopping desires… Now whenever I see a discount, I’ll justify it to myself with a: “I’m helping the economy by helping the market return to a stable point for OTHER shoppers”. See, it’s not really about me at that point, I’m trying to help my community…kind of. On a more serious note, this week I’ve been learning about supply and demand curves which has been interesting and contradicting at the same time. For those who don’t know what supply and demand curves are, they quantify the market prices of goods or services with respect to the suppliers and demanders.

More generally, I’ve been learning more about labor economics this week through Marginal Revolution University’s online courses. I think recognizing the changes and evolution of labor in America has been an integral part of how corporate workplaces have determined hiring patterns and cycles. For a little history, we saw that back in the 1950s, the majority of the labor force worked in manufacturing and most of the people who worked in this industry were men while women were seen more in the services industry like teaching or medicine. However, as our economy has evolved, things like the service industry have become more mainstream jobs; while jobs in manufacturing have been replaced by technology and innovation to make the processes faster.

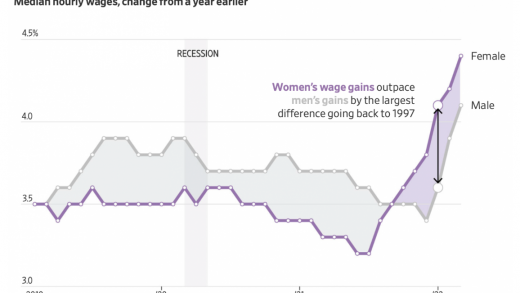

This evolution of the labor force participation is important for how much jobs are valued at and similarly amongst the gender inequalities that we are seeing. Today, some of the highest paying jobs are amongst the financial industries which is often overlooked as a career path but just as successful as some of the more well known ones like the medical industry. However, the only difference is, the gender inequalities in the finance industry are often more pronounced than ever. The interesting part is, women and men have roughly the same entry rate into this industry which means that we don’t have a lack of interest per se, but rather a lack of retention. In this article by McKinsey, Closing the Gender and Race Gaps in North American Financial Services, they highlight that at the entry level of financial sector jobs women have a slight edge in participation of 52% to 48%, but from an entry level job to a C-suite level, the amount of women drops by 80%. These numbers are indicative of the lack of women that we have in business leadership.

The real question now is why? Why does the participation drop so much? What factors are perpetuating these circumstances? Are the hours too long? What extenuating circumstances could cause that dramatic of a drop? Hopefully I’ll find some answers to these questions in the coming week!

Preview for next week: I have some exciting interviews lined up with some industry experts with unique points of views and I’m excited to meet them and share my findings!

See you next week!